| “Setting the table” for development |

|

|

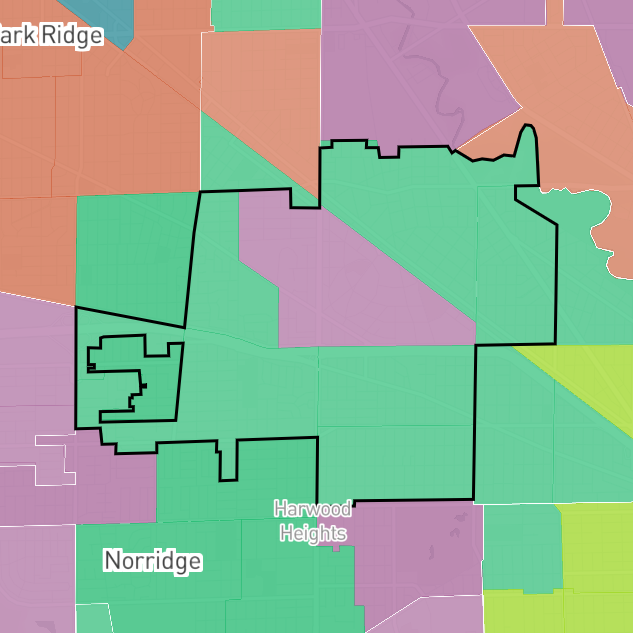

Communities should take steps to prepare for and attract private market real estate investment. Although communities in Submarket 4 have older housing stock and moderate-value homes, they still have many assets on which to build. However, Submarket 4 communities may not be prepared to leverage these assets because, in some cases, they have not taken strategic steps such as addressing troubled properties, improving streetscapes, updating development regulations, or assessing market conditions to prepare for development.

- Maintaining distressed properties Communities can take steps to secure and conceal vacant or abandoned properties.

- Communities can take steps to secure and conceal vacant or abandoned properties. Reducing the visible signs of distress on a block, such as the negative effects of foreclosures or short sales, can help maintain nearby property values. Illinois law allows for priority liens for securing and maintaining abandoned residential property, and covers the removal of weeds, trees, bushes, grass, garbage, debris, or graffiti, and securing or enclosing the property. Under this law, municipalities recover their expenses after taxes are paid but before the mortgage is recovered. Thus, municipalities will recover even when the value of the property is less than the value of the mortgage. If municipalities are maintaining vacant property in their community, they should be sure to go through the necessary steps to file a high priority lien on the property. The Metropolitan Mayors Caucus and BPI’s publication on Vacant Building Ordinances provides detailed information and step-by-step guidance on this process. Learn more about strategies to deal with vacant property.

- Make visible investments Investments in the public-facing streets and façades of the community can help signal a positive investment climate to private developers and improve quality of life for residents.

- Investments in the public-facing streets and façades of the community can help signal a positive investment climate to private developers and improve quality of life for residents. Façade and streetscape improvements may be funded by establishing a local Business Improvement District (BID), Special Service Area (SSA), or Tax Increment Financing (TIF) district. These mechanisms use property taxes to gather financial resources for improvements. The City of Chicago’s TIF-Neighborhood Improvement Program (TIF-NIP) is a good example of how to structure a program to encourage exterior repairs and improvements.

- Review regulations affecting real estate development To better compete for private market real estate investments, communities can preemptively inventory and update development regulations.

- To better compete for private market real estate investments, communities can preemptively inventory and update development regulations. Development regulations protect community health, character, and safety, but can also sometimes be outdated or create unintended barriers to private investment. Some regulations are especially onerous and limit developer interest in investment, while others prohibit forms of development the community may wish to allow. For instance, density limitations may prohibit condo buildings in communities’ historic downtowns. Large minimum lot sizes may prevent the development of starter homes or housing for older community residents. Similarly, point-of-sale requirements may excessively extend home sale transaction timelines. Communities should audit and potentially refresh existing regulations to ensure that they are not creating unintended or unnecessary barriers to development. Assistance may be available through the Urban Land Institute or local associations of realtors to help evaluate perceptions among private market actors of the difficulty of working in the community.

- Value of housing planning Municipalities should invest in planning to help define community character and long-term goals.

- Municipalities should invest in planning to help define community character and long-term goals. In order to determine which strategies to pursue most actively, Submarket 4 communities must establish a market-feasible vision for future development. There are multiple avenues for evaluating alternatives and setting goals for the community, including hiring a market consultant, engaging in comprehensive planning, or undertaking a local housing plan, such as those provided by Homes for a Changing Region.

|

| Attracting investment |

|

|

Communities will need to develop creative strategies to attract additional investment and development. Incentivizing infill can be difficult in mostly built-out areas. Many financial institutions do not provide mortgage products for homes at lower price points, limiting the ability to attract new families into some neighborhoods. Rehab may be needed in some areas, but homeowners may not be able to tap into equity loans because of poor market conditions. High property tax rates in some communities prohibit investment and limit affordability.

- Approach to rehabilitation Municipal rehab programs can help certain residents address issues of deferred property maintenance.

- Municipal rehab programs can help certain residents address issues of deferred property maintenance. Municipalities in Cluster 5 may consider developing rehab grant or loan programs for certain income-qualified homeowners. Many municipalities around the region have developed these programs, some with the support of federal Community Development Block Grant (CDBG) funding (Oak Park, Evanston) and others through their own municipal sources (East Dundee). Neighborhood Lending Services, Inc. (NLS) offers fixed rate home improvement loans in certain areas of the region. Municipalities in these areas should assist NHS with marketing to residents. Municipalities may also want to consider partnering with local banks to explore the development of a rehab financing product for their residents. Read more about the many different models of rehabilitation programs in the region.

- Land banking Land banks can be used as a strategic tool to acquire problem vacant properties and convert them into assets.

- Land banks can be used as a strategic tool to acquire problem vacant properties and convert them into assets. Land banks are governmental entities or nonprofit corporations that focus on the conversion of vacant, abandoned and tax delinquent properties into productive use and have proved to be a useful tool to help reinvent and revitalize neighborhoods. Most vacant and abandoned properties have many legal and financial barriers, such as years of back taxes and clouded title that make it difficult to attract investors. Land banks have the ability to hold land tax-free and clear title and/or extinguish back taxes, which can be essential when trying to attract buyers and investment. Land banks can work in partnership with municipalities to advance community-based goals. There are two successful examples of land banks in Illinois, in both the south suburbs and Cook County, and other areas of the region struggling with issues of vacancy and blight might consider the use of land banking as a tool in their community. The Center for Community Progress is a good starting point to learning about land banking. Learn more about strategies to deal with vacant property.

- Placemaking and marketing strategies Communities should develop strategies to create greater neighborhood identity in order to encourage additional private sector investment.

- Communities should develop strategies to create greater neighborhood identity in order to encourage additional private sector investment. Municipalities can make a concerted effort to enhance neighborhood character in Submarket 5 through strategic public investments such as neighborhood branding/signage, streetlights, sidewalks, etc. Public sector investment will likely signal to the private market a commitment to an area and make it more attractive for additional resources. Learn about placemaking strategies.

- Review regulations affecting real estate development To better compete for private market real estate investments, communities can preemptively inventory and update development regulations.

- To better compete for private market real estate investments, communities can preemptively inventory and update development regulations. Development regulations protect community health, character, and safety, but can also sometimes be outdated or create unintended barriers to private investment. Some regulations are especially onerous and limit developer interest in investment, while others prohibit forms of development the community may wish to allow. For instance, density limitations may prohibit condo buildings in communities’ historic downtowns. Large minimum lot sizes may prevent the development of starter homes or housing for older community residents. Similarly, point-of-sale requirements may excessively extend home sale transaction timelines. Communities should audit and potentially refresh existing regulations to ensure that they are not creating unintended or unnecessary barriers to development. Assistance may be available through the Urban Land Institute or local associations of realtors to help evaluate perceptions among private market actors of the difficulty of working in the community.

|

| Code issues |

|

|

Finding a balance between too aggressive and too lenient code enforcement can be difficult. In some parts of Submarket 5, where the market is weaker, communities struggle to find the right balance in addressing code issues. Too aggressive enforcement can lead to vacancy and reduced neighborhood stability because building owners cannot afford to make all the repairs. Burdensome point of sale requirements may deter new investment in the community, and challenges with staff capacity can often result in long waiting periods to complete required inspections. On the other hand, too lenient enforcement can lead to deteriorating property conditions and households living in unsafe or unsanitary homes. The results of either approach compound over time and can serve as a deterrent to future market-driven rehabilitation.

- High priority property maintenance liens Municipalities should utilize priority liens to recover costs incurred for securing and maintaining abandoned residential property.

- Municipalities should utilize priority liens to recover costs incurred for securing and maintaining abandoned residential property. Illinois law allows for priority liens for securing and maintaining abandoned residential property. The law applies to any type of permanent dwelling unit that has been unoccupied for at least 90 days and for which the municipality attempted to contact the owner(s) or the owner’s agent(s) but was unable to reach anyone. It covers the removal of weeds, trees, bushes, grass, garbage, debris, or graffiti, and securing or enclosing the property. Liens obtained under this law are superior to all other liens, except taxes. Under this law, municipalities recover their expenses after taxes are paid but before the mortgage is recovered. Thus, municipalities will recover even when the value of the property is less than the value of the mortgage. If municipalities are maintaining vacant property in their community, they should be sure to go through the necessary steps to file a high priority lien on the property. The Metropolitan Mayors Caucus and Business and Professional People for the Public Interest’s (BPI) publication on Vacant Building Ordinances provides detailed information and step-by-step guidance on this process. Learn more about strategies to deal with vacant property.

- Rental unit monitoring and regulation Effective municipal regulation, coupled with pro-active strategies and incentives, can improve rental housing quality and reduce problems.

- Effective municipal regulation, coupled with pro-active strategies and incentives, can improve rental housing quality and reduce problems. With the number of rental properties in this Submarket, municipalities need to review the structure of their rental unit monitoring and regulation efforts to make sure that they are maximizing authority under state law while effectively maintaining the quality of the local rental stock. Municipalities may want to consider implementing a performance-based rental regulation ordinance such as the one in place in the Village of Addison. Municipalities may also want to point owners of multifamily rental properties to the abundance of resources at the Community Investment Corporation (CIC) for financing, energy efficiency, and property management training. Learn about best practice rental regulation strategies.

- Strategic code enforcement on vacant properties Code enforcement departments should create targeted intervention strategies based on certain property characteristics.

- Code enforcement departments should create targeted intervention strategies based on certain property characteristics. Maintenance of vacant and abandoned property is important in order to not deter additional investment in a neighborhood. Some municipalities have reported that boarding vacant properties actually discourages neighborhood investment and the best strategy is to make a property appear occupied. Code enforcement departments should maintain vacant property to the best of their ability and issue priority property maintenance liens as necessary. Even sending a notice to a property owner that a priority lien will be issued may encourage an owner to pay past fines or start taking an interest in the property. However, it is important for code enforcement departments to also make a plan when it is clear that the owner of a property is no longer being responsive. Outlining a strategy to identify properties that may need more aggressive intervention is important. At a certain point when the owner is no longer responding it may be more cost efficient in the long run to intervene with a more aggressive strategy. Communities must be willing to utilize the full arsenal of enforcement tools, including demolition or declaration of abandonment, if necessary. Learn more about strategies to deal with vacant property.

- Utilize demolition, fast-track, and abandonment authority More aggressive strategies may be needed when owners become unresponsive.

- More aggressive strategies may be needed when owners become unresponsive. When it is clear an owner of a vacant property is no longer being responsive, municipalities should consider more aggressive strategies. The Metropolitan Mayors Caucus and BPI’s publication on Vacant Building Ordinances provides detailed information and step-by-step guidance on abandonment, fast track demolition, and declaration of abandonment. Some south suburban municipalities have used their abandonment authority to take control of problem properties and then partner with the South Suburban Land Bank to transfer ownership of these properties to responsible owners. The Village of Lansing has been using abandonment petitions to gain control of vacant properties, reduce strain on municipal resources, and attract investment. Learn more about strategies to deal with vacant properties.

|

| Form matches current demand |

|

|

These walkable, higher density communities with access to rail transit may be attractive to current consumers. Due to their age, many Submarket 4 communities are close to the City of Chicago, or within older subregional job centers like Aurora or Waukegan, with strong access to public transit resources. Many of these older communities also have architecturally notable smaller homes on smaller lots, which may be an asset considering changing consumer preferences. Combined with walkable, moderate-density town centers, these assets have the potential to attract investment, especially as family formation continues among millennials.

- Placemaking and marketing strategies Communities should develop strategies to create greater neighborhood identity in order to encourage additional private sector investment.

- Communities should develop strategies to create greater neighborhood identity in order to encourage additional private sector investment. Municipalities can make a concerted effort to enhance neighborhood character in Submarket 4 through strategic public investments such as neighborhood branding/signage, streetlights, sidewalks, etc. Public sector investment will likely signal to the private market a commitment to an area and make it more attractive for additional resources. Learn about placemaking strategies. In addition, marketing the local community can also be useful. However, any marketing campaign must be based in frank self-assessment of existing assets and market realities. The “Why Berwyn?” campaign provides a good example of an asset-based approach to community marketing.

- Value of housing planning Municipalities should invest in planning to help define community character and long-term goals.

- Municipalities should invest in planning to help define community character and long-term goals. In order to determine which strategies to pursue most actively, Submarket 4 communities must establish a market-feasible vision for future development. There are multiple avenues for evaluating alternatives and setting goals for the community, including hiring a market consultant, engaging in comprehensive planning, or undertaking a local housing plan, such as those provided by Homes for a Changing Region.

|

| Moderate cost but rising levels of cost burden |

|

|

Although housing costs are relatively low, community members may still struggle with housing payments. Many residents benefit from the moderate costs associated with living in Submarket 4 communities. However, due to stagnant or declining incomes, some owners and renters are now paying more than they can afford on rent or mortgage and utilities. As the share of households struggling with housing costs rise, it becomes less likely that homeowners will have resources to maintain or improve their homes, and some residents may be vulnerable to homelessness.

- Housing counseling Programs to help homeowners affordably purchase homes and avoid foreclosure can increase community stability.

- Programs to help homeowners affordably purchase homes and avoid foreclosure can increase community stability. Although Submarket 4 communities were not the most severely affected by the 2008 housing crisis, effects of the crisis—in terms of foreclosures, distressed sales, and cash sales—still remain. To help owners confronting foreclosure and make sure new owners are taking out affordable, sustainable loans, Submarket 4 communities should strengthen connections with their local HUD-certified housing counseling agencies and encourage residents to seek counseling. Housing Action Illinois, the statewide housing counseling intermediary, can help communities identify appropriate counseling resources.

- Preservation and expansion of affordable housing Supporting residents with affordable housing can help meet cost burden challenges.

- Supporting residents with affordable housing can help meet cost burden challenges. Since the share of community members in Submarket 4 struggling to pay for housing is growing, municipalities should seek non-profit partners to develop permanent affordable housing options within their boundaries. In Submarket 4 communities, affordable ownership and apartment programs could both be valuable. Affordable homeownership programs help moderate-income residents purchase homes through grants and low-cost loans. Affordable apartments, on the other hand, create lower-rent options that consume a sustainable portion of low-income households’ income.

|

| Proximity |

|

|

Communities may have an opportunity to build off of nearby assets. Submarket 5 spans a wide geography across the region, and in many areas there is bordering proximity to assets such as strong school districts and transit lines. Communities within submarket 5 should closely evaluate the relationship of their submarket to other submarkets and assets to take advantage of potential opportunities to attract investment.

- Value of housing planning Using tools like Homes for a Changing Region can be valuable.

- Using tools like Homes for a Changing Region can be valuable. In order to determine which strategies to pursue most actively, Submarket 5 communities must establish a market feasible vision for future development. Homes for a Changing Region is a very valuable tool that can help communities identify how to plan for the future of the local housing market and identify which strategies to prioritize.

|

| Rehabilitation challenges |

|

|

The age and condition of homes may be a barrier to redevelopment, despite other advantages. Moderate home values in Submarket 4 have an effect on resources available to renovate properties both for existing homeowners and potential in-movers. If the value of a renovated home at sale is lower than the investment required to perform desired renovations, bank capital for rehabilitation may be limited. Public sector partners can help bridge this gap with low-cost loans and grants for rehabilitation. However, even where available, these programs are not always widely used when the cost of renovations greatly exceeds the amount of individual assistance available.

- Approach to rehabilitation Municipal rehab programs can help certain residents address issues of deferred property maintenance.

- Municipal rehab programs can help certain residents address issues of deferred property maintenance. Municipalities in Submarket 4 may consider developing rehab grant or loan programs for certain income-qualified homeowners. Many municipalities around the region have developed these programs, some with the support of federal Community Development Block Grant (CDBG) funding (Oak Park, Evanston) and others through their own municipal sources (East Dundee). Neighborhood Lending Services, Inc. (NLS) offers fixed-rate home improvement loans in certain areas of the region and municipalities in these areas should assist NLS with marketing to residents. Municipalities may also want to consider partnering with local banks to explore the development of a rehab financing product for their residents. Read more about the many different models of rehabilitation programs in the region.

- Meeting the needs of aging residents As the region ages, it is critical for communities to address the housing needs of older adults.

- As the region ages, it is critical for communities to address the housing needs of older adults. Many homeowners in Submarket 4 are aging and in need of high-quality housing options that fit their current stage in life. Submarket 4 communities may want to explore grant programs for aging-in-place that provide updates like bathroom grab bars that help older home owners stay in their homes. In addition, federally subsidized apartment buildings limited to seniors can provide important options for older residents on a fixed income. Finally, allowing higher-density residential development in Submarket 4 downtowns can help provide apartment and condo options for downsizing seniors to remain in the community.

Rehab programs may be underutilized. In response to deferred maintenance and code issues, many communities operate housing rehabilitation programs. These programs are not always heavily used, in part, because the cost of bringing the house up to code exceeds the funding available.

- Approach to rehabilitation Municipal rehab programs can help certain residents address issues of deferred property maintenance.

- Municipal rehab programs can help certain residents address issues of deferred property maintenance. Municipalities in Cluster 5 may consider developing rehab grant or loan programs for certain income-qualified homeowners. Many municipalities around the region have developed these programs, some with the support of federal Community Development Block Grant (CDBG) funding (Oak Park, Evanston) and others through their own municipal sources (East Dundee). Neighborhood Lending Services, Inc. (NLS) offers fixed rate home improvement loans in certain areas of the region. Municipalities in these areas should assist NHS with marketing to residents. Municipalities may also want to consider partnering with local banks to explore the development of a rehab financing product for their residents. Read more about the many different models of rehabilitation programs in the region.

|

| Weak market demand |

|

|

Declining home values put homeowners at risk. Homeowners in Submarket 5 may be particularly challenged due to declining housing values, which puts residents in this submarket the most at risk of having underwater mortgages.

- Housing counseling Communities should familiarize themselves with any HUD certified housing counseling agencies in their area and market their services to residents.

- Communities should familiarize themselves with any HUD certified housing counseling agencies in their area and market their services to residents. Housing Action Illinois provides information about housing counseling agencies across the region, which provide an array of housing programs and services. Residents can get access to financial management and budget counseling, mortgage delinquency and default counseling, pre-purchase education, one-on-one homeownership counseling, rental information, fair housing guidance, rehabilitation programs, reverse mortgage counseling, homeless prevention support, predatory lending education, and foreclosure prevention options.

- Placemaking and marketing strategies Communities should develop strategies to create greater neighborhood identity in order to encourage additional private sector investment.

- Communities should develop strategies to create greater neighborhood identity in order to encourage additional private sector investment. Municipalities can make a concerted effort to enhance neighborhood character in Submarket 5 through strategic public investments such as neighborhood branding/signage, streetlights, sidewalks, etc. Public sector investment will likely signal to the private market a commitment to an area and make it more attractive for additional resources. Learn about placemaking strategies.

- Refinancing resources Municipalities should market IHDA's I-REFI program to homeowners who may be underwater on their mortgage.

- Municipalities should market IHDA's I-REFI program to homeowners who may be underwater on their mortgage. For homeowners with underwater mortgages, the Illinois Housing Development Authority (IHDA) is offering a new program designed to help homeowners who are current on their mortgage payments but owe more than their home is worth due to declining property values in their community. Through the new I-REFI program, IHDA offers underwater homeowners up to $50,000 in federal assistance to reduce the balance owed on their mortgage and refinance into a new affordable loan based on the current market value of their home. This program may be of particular relevance in Submarket 5 municipalities and should be marketed to residents.

|

Regional Housing Solutions

Regional Housing Solutions